Exactly How Much Does Auto Insurance Coverage Price For Teenagers and Those Under 25? The typical price for car insurance coverage costs varies across the board (low cost).

For the sake of simplicity, we'll talk regarding car insurance standard coverage, which almost every state needs its vehicle drivers to bring. The ordinary annual costs rate for auto insurance policy is anywhere from $1,300 to $1,800.

insured car cheapest auto insurance insured car cars

insured car cheapest auto insurance insured car cars

Allow's say that an 18-year-old motorist is guaranteed with vehicle insurance policy standard protection. The monthly premium price for a motorist that young would be around $598 for an annual premium of $7,179. Already, you can see exactly how this age team is taken into consideration to be the most expensive to insure according to insurers.

At 20, the automobile insurance coverage premium decreases by 11% to around $5,333. insurance companies. If no cases are filed, or mishaps are reported, after that by the age of 25, the chauffeur will have their automobile insurance policy annual costs readied to $3,207 after the insurance coverage testimonial. This is the ordinary rate for drivers 25 and also older.

48 out of 50 states have their very own car insurance policy protection limits for just how much their vehicle drivers should lug. This car insurance coverage pays for injuries you cause to one more driver while out on the road -an attractive lawful technique. perks. Complete vehicle insurance coverage refers to the enhancement of an accident as well as comprehensive policy (low cost).

The smart Trick of 10 Factors That Affect Car Insurance Rates - Credit Karma That Nobody is Talking About

trucks cheaper automobile risks

trucks cheaper automobile risks

When it comes to an ordinary cars and truck vehicle driver, complete car insurance policy sets you back as much as $200 a month or a $2,399 yearly costs -at the very least $700 greater than a typical car insurance protection with a lot of insurers. risks. From that alone, you might have an idea of how expensive it can be for teens and brand-new motorists under 25.

How Does Auto Insurance For Young Men As Well As Females 25 And Under Differ by Year? As previously stated, Since we've seen the distinction in cars and truck insurance premium prices an ordinary chauffeur would pay in contrast to a teenager and also a new driver under 25, let's discuss exactly how those teens as well as vehicle drivers under 25 contrast to every various other based https://seoreporting.tiny.us/yv37ueuu upon sex (auto insurance).

The average yearly price for 19-year-old guys is $6,021, while ladies see annual prices of around $5,661. The yearly rate found amongst 20-year-old males is $5,590, while women have rates around $5,079. By the time they transform the drinking age, men can pay annual auto insurance coverage premium rates approximately $4,980 while females pay up to $4,121 - cheapest car.

At the exact same time, you have actually possibly discovered exactly how the bigger car insurance policy costs lowers when the driver is more youthful. business insurance. Around the time they transform 21, the auto insurance policy premium prices do continue to lower however in smaller sized amounts. insurance company. An instance would be the 17% reduction from $5,333 to $4,453 when a chauffeur transforms 21 in contrast to the 7% decrease from $4,128 to $3,840 when a vehicle driver turns 23.

When your car insurance provider sees them, they may increase your auto insurance policy prices - vans. A reduced credit report or delinquent payments can be noted by your car insurance provider if the state allows it - car. Falling back on your costs can cause auto insurance coverage costs rates enhancing or continuing to be the very same with many insurance firms.

Facts About What Age Does Car Insurance Go Down? - Progressive Revealed

low-cost auto insurance trucks auto low-cost auto insurance

low-cost auto insurance trucks auto low-cost auto insurance

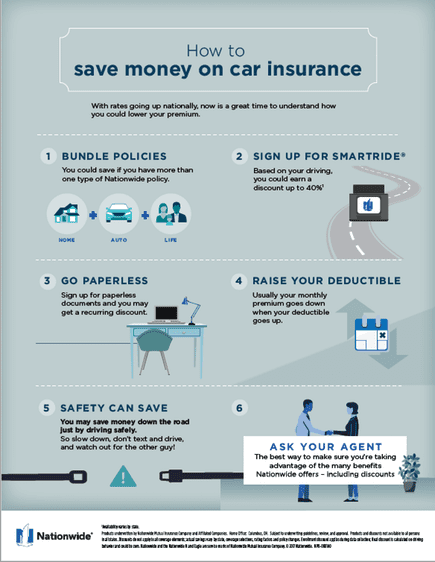

While your cars and truck insurance policy costs prices may decrease, they might not be by a lot. cheapest. What Can You do to Reduction Your Car Insurance Policy Costs?

You must just get thorough and collision automobile insurance policy if your lorry has a high value; otherwise, it will not be worth it. vehicle insurance. The question is who's car insurance plan would that be? Generally, young adults and also young drivers are provided on their parents' lorry insurance coverage which is much more affordable than opening their very own car insurance plan (affordable).

There are a couple of automobile insurance policy companies where teenagers or young chauffeurs can earn discount rates based on their secure driving practices and education (vehicle insurance). The method to find these vehicle insurer is to shop about and inquire about their safe chauffeur discounts. Connecting to the previous tip about discounts, the ideal method to discover car insurance policy offers is to look around neighborhood and national names for the most affordable car insurance costs prices for new chauffeurs under 25.

This may distinctly relate to chauffeurs under 25 or elderly people. A defensive training course certificate shows your vehicle insurance policy firm that you are proactively trying to come to be a more secure chauffeur (low cost auto). The even more anybody drives, than more likely they are to get right into a crash and also thus riskier to guarantee one's auto.

insure auto insurance credit score insurance company

insure auto insurance credit score insurance company

Referring to the previous section, shop around for teens and also new motorist auto insurance costs. Auto insurance coverage needs some comparing and contrasting as cars and truck insurance policy companies almost everywhere price their automobile insurance policies differently (cheaper cars).

Little Known Questions About Adding A Teen To Your Auto Insurance Policy - Incharge Debt ....

You didn't have a crash. You didn't file a claim. You really did not also get a speeding ticket. Why might your cars and truck insurance policy rate rise anyhow? To comprehend rate increases, it is essential to recognize that premium estimations are based upon your risk and also the forecasted expense it would take to fix or replace your automobile.